Anchor Protocol - Gold Standard for Passive income on Blockchain

Blockchain technology has come a long way from its initial recognition of being merely an alternative to fiat money to a whole financial system being developed around it — Decentralized Finance. Anchor Protocol is on a mission of setting a benchmark interest rate for DeFi.

DeFi refers to a system that provides users autonomous and decentralized access to financial services by utilizing smart contracts on blockchains. Unlike traditional centralized financial intermediaries, DeFi has no central authority and is free from regulation. DeFi protocols owing to their innovative offerings have become increasingly popular in the recent past. The growth and adoption of the DeFi industry is imminent and is marked by the development of hundreds and thousands of exchanges and liquidity pools and advancing tech infrastructure.

The growth and advancement in this space has led to the inception of incredible products covering a range of use cases from collateralized lending to prediction markets. The market is flooded with innovations on a daily basis allowing anyone and everyone to permissionlessly lend, borrow, save and trade. All one needs is an internet connection and a compatible Web 3.0 wallet. However, the myriad of choices available coupled with the volatility of crypto assets, low-interest rates, illiquidity of staked assets, and the complexity associated with understanding the protocols has hindered mass adoption. The volatility of the crypto assets makes staking a risky option for an average investor with a low-risk appetite. At the same time, the cyclical nature of stablecoin interest rates on other protocols makes it unsuitable for most household investors.

What this space lacks is a safe and simple savings product. One that is designed with mass appeal and is simple, convenient, and provides high yields in an otherwise perpetually low interest rate environment.

ENTER ANCHOR (www.anchorprotocol.com)

“Anchor Protocol is a savings vehicle built on the Terra blockchain in the Cosmos ecosystem that provides a benchmark interest rate for DeFi”.

Anchor is the first inter-chain DeFi application that pools the emission from PoS blockchains, stabilizes it, and passes it on as fixed, high-yield interest to depositors. Built by South Korea-based Terraform Labs and launched on March 17, 2021 Anchor with its simplicity and ease of integration successfully bridges the gap between DeFi’s composability and mainstream adoption as a savings product with mass appeal.

Anchor is a principal-protected stablecoin savings product that pays depositors a stable interest rate. And, it achieves this by stabilizing the deposit interest rate with block rewards accruing to assets that are used to borrow stablecoins. The savings protocol accepts Terra deposits, permits instant withdrawals, and provides depositors with a low-volatility interest rate with the ultimate vision of becoming the gold standard for passive income on the blockchain.

How does it work?

Anchor empowers the average street investor who is otherwise skeptical and refrains from venturing into the world of DeFi. With just a few clicks, it provides them a stable and reliable return on their investments across all PoS blockchains. It does so by aggregating block rewards from all PoS blockchains while aspiring to set the blockchain economy’s benchmark interest rate.

In order to generate yield, Anchor protocol lends deposits to borrowers who in turn provide liquid-staked PoS assets from major blockchains as collateral (bAssets). Anchor stabilizes the deposit interest rate by passing on a variable fraction of the bAsset yield to the depositor, thus guaranteeing depositors’ principal by liquidating borrowers’ collateral through liquidation contracts and third-party arbitrageurs.

Anchor protocol represents a decentralized money market between a depositor seeking stable and fixed-rate yields on their stablecoins and a borrower seeking stablecoins through stakeable assets. Depositors can deposit stablecoins (UST) for high yields upto 20 percent APY. With Orion Money, Ethereum-based stablecoins like DAI, USDT, USDC, BUSD can be wrapped on EthAnchor for earning Anchor’s high yields. Anchor also plans to introduce non-USD pegged coins in the future. Borrowers can borrow UST against stakeable assets (Luna and Ethereum) as collateral. These assets are called bonded assets or bAssets. The bonded assets are locked up and UST is borrowed against these at an LTV ratio defined by the protocol. The staking rewards earned on bAssets like bLuna and bETH are liquidated by the protocol into UST for depositors allowing them to earn target yield up to 20%. The high APY is due to Luna’s staking yield and the maximum LTV rate. The loans are over-collateralized which contributes to the high APY.

What are bAssets?

A core essential of Anchor protocol is the bAsset or the bonded asset. bAsset is simply a token that represents ownership of a staked PoS asset. Like the underlying staked assets, bAssets pay the holder block rewards. The problem of illiquidity of staked assets is solved by the liquidity of bAssets. bAssets are responsible for stakeholders gaining liquidity and fungibility over their staked assets, allowing the locked value to be used in dApps like Anchor. bAssets can thus be transferred and transacted just like the underlying PoS asset.

Terra Money Market

Terra Money market is the core building block of the Anchor protocol which is a WASM (web assembly) smart contract on the Terra blockchain that facilitates depositing and borrowing of UST (other stablecoins in the future). Like any money market, it is defined by Terra pool deposits that earn interests from borrowers. Borrowers use their bLuna or bETH as collateral to borrow UST from the pool. The interest rate is determined algorithmically as a function of borrowing demand and supply.

The borrowing capacity is determined by the amount and quality of locked-up collateral. Anchor defines a loan-to-value ratio (LTV) for each type of collateral, which indicates the fraction of a collateral asset’s value that contributes to a debt position’s borrowing capacity.

The borrow page shows the collateral value along with the maximum LTV ratio, which in this case is 60%. It also shows users’ LTV ratio based on the borrowed value.

Anchor ensures the protection of the principal through a liquidation protocol. It ensures deposit protection through over-collateralization of all the borrowings. The liquidation protocol maintains deposit safety by paying off debts that are at risk of violating collateral requirements using a liquidation contract. A liquidation contract undertakes the task of paying back debt in exchange for collateral along with the liquidation fee. Beyond the savings product, there is an entire ecosystem of projects revolving around the Anchor protocol. Users can also participate in Anchor liquidation pool, a higher-risk, higher-return product that provides liquidation financing for Anchor debt positions.

Anchor Token & Tokenomics

ANC is the native and governance token of Anchor protocol. Users have to deposit ANC to create governance polls. Voting power is proportional to the amount of ANC staked in the vote. Voters with a higher ANC stake in the vote will have higher voting power to decide whether or not to implement the changes listed in a governance poll.

ANC is designed to capture a portion of Anchor’s yield, allowing its value to scale linearly with Anchor’s assets under management. This means that ANC stakers receive protocol fees pro-rata to their stake and benefit as adoption of Anchor increases. ANC tokens are also distributed as incentives to UST stablecoin borrowers, proportionally to the amount borrowed. Anchor protocol has a total supply of 1 billion ANC tokens and 40% of that has been set aside as borrower incentives for the next 4 years. This means that users are rewarded for borrowing UST, and both lender and borrower can earn using Anchor. Anchor’s TVL has already crossed 4.5 billion USD and is only expected to go up.

The dashboard shows the TVL including the yield reserve, total deposits, total Collateral, ANC price, supply and market cap as well as ANC buyback information.

For further information, please refer to the docs.

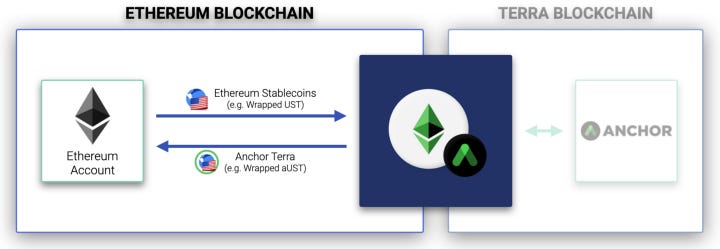

EthAnchor Gateway

EthAnchor provides a gateway for Ethereum users and dApps to interact with Anchor using Ethereum stablecoins. Ethereum based stable coins like USDT, USDC, DAI dominate the market with a share of over 85%. UST which is the algorithmic stablecoin of Terra is fast growing and has a promising future but a mere 2% share in this market. EthAnchor is simply a set of smart contracts that contributes to the expansion of the Anchor Protocol offering, to Ethereum-based stablecoins, allowing users to deposit a greater variety of stablecoins on Anchor Protocol.

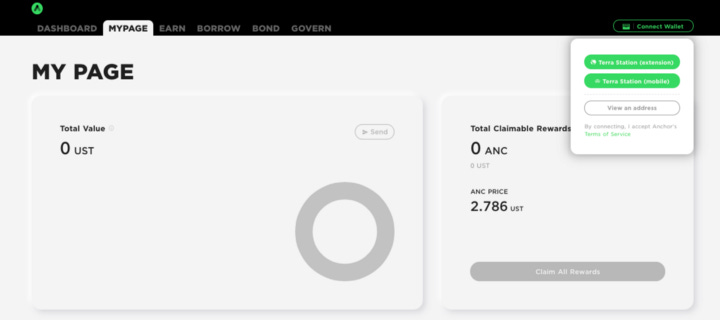

Step-by-step guide on using the Anchor App

Let’s go through different ways Anchor enables users to earn ANC through a walkthrough of the Anchor app.

Earn — This allows users to deposit UST and earn interest on the deposit.

Connect your wallet through Terra Station (Extension or Mobile).

Once the wallet is connected, deposit your UST to earn a yield of about 20%. It displays the APY and the expected interest at the end of the year.

Borrow — This allows users to deposit bonded assets and borrow UST against those assets. Anchor allows borrowing against bLuna and bETH.

Deposit bLuna or bETH to provide collateral. Luna can be bonded for bLuna on Anchor (shown under bond tab).

bETH can be obtained from Terraswap. ETH/stETH can also be bridged over to Terra using the Anchor-Lido Bridge.

UST can be borrowed against the deposited bLuna or bEth. It displays the borrowing APR and the LTV ratio of your borrowed amount alongwith the maximum LTV. It also displays the Net APR which is the difference between the distributed APR and the borrowed APR.

Bond — It lets you bond your Luna for bLuna. You can select the amount of Luna, choose the validator. It shows the amount of bLuna and the price of bLuna per Luna.

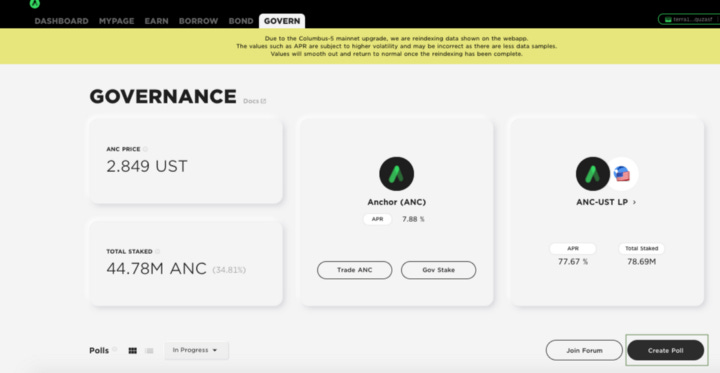

Governance — Governance lets ANC token holders participate in governance, staking, or simply providing liquidity. It displays the price of the ANC token and the total amount of staked ANC.

ANC tokens can be traded using the trade option. The Gov Stake next to trade lets you stake the ANC tokens with the APR displayed above it.

Users can also provide liquidity through ANC-UST pool. It displays the APR and the total staked amount.

Creating a governance pool also requires a minimum ANC token amount and so does the voting. The voting power is proportional to the amount of ANC staked in the vote.

To make things easier, I have made a video tutorial where Luna is bonded for bLuna and used as collateral to borrow UST. Borrowed UST is then deposited to earn yield at an incredible APY of around 19%. Liquidity is provided by depositing ANC and UST in the ANC-UST liquidity pool.

Summary

Anchor protocol is pushing the boundaries of DeFi by offering products and solutions that have reduced the barriers of adoption between the blockchain world and the traditional financial world. Anchor offers a principal-protected, stablecoin savings solution to the risk-averse investor which makes it the perfect household savings product. It has a sustainable business model which will drive DeFi further. As for Terra, It brings value from other blockchains onto it through the EthAnchor gateway.

The growth so far has been considerable and with the DeFi sector booming, the timing of this product which is billed as the “Stripe for Savings,” couldn’t have been better.

“Stable & attractive yields denominated in the dollar, and composable in smart contracts is the holy grail of cryptocurrency,” says Do Kwon, Co-Founder and CEO of Terra. “Anchor’s attractive yields on TerraUSD is going to lead millions of households to move their savings onto Anchor’s smart contracts, and will bring DeFi from the fringe to the mainstream.”

Whether Anchor will be able to achieve this is yet to be seen but so far the numbers and odds are in its favor. Anchor is surely heading in the right direction aiming to become the gold standard for passive income on the blockchain.

I need your love and support. Please give it a like or follow or subscribe so that I can keep writing what I love.

Socials

Substack, Loop, Torum, Odysee, Twitter, Youtube, Read.cash, Publish0x, Presearch, Medium, Noisecash

Crypto Taps Pipeflare, GlobalHive, GetZen for some free crypto

Exchange on SwapSpace

For price updates, check Coinmarketcap or download the app on Apple/ Google

Join CMC for Airdrops, Diamonds, Learn&Earn

On Telegram(G), Telegram(EN), Twitter, Reddit, Instagram, Facebook

Create your crypto Watchlist or track your Portfolio on Coinmarketcap