The total stablecoin market cap, excluding algorithmic stables, has just hit a new all-time high

According to DeFiLlama, this surpasses the previous peak from early 2022

Fresh capital is flowing into crypto

And @ethena_labs has been at the forefront of the stablecoin world this year

1/

Stablecoins

Most crucial and widely adopted instruments in this space

Have found unmatched Product-Market Fit

- Over 90% of orderbook trades and 70% of onchain settlements are denominated in stablecoin pairs across both CEXs and DEXs

- Represent two of the top five largest crypto assets

- Account for more than 40% of the TVL in DeFi

2/

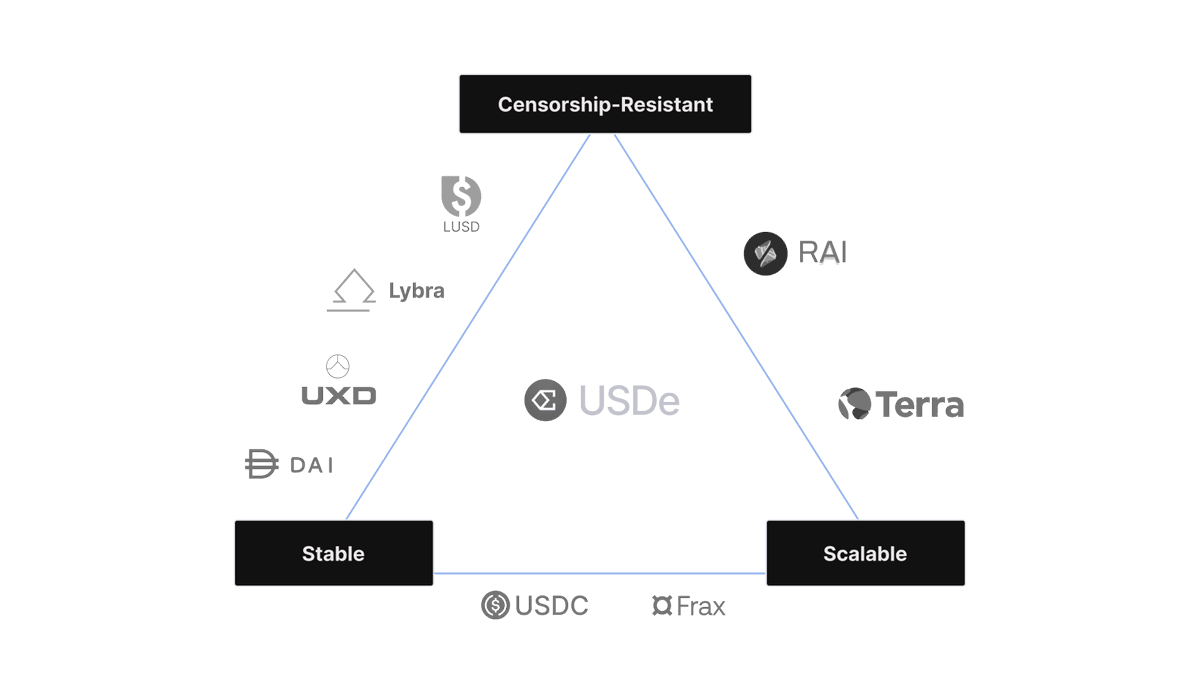

But there's a PROBLEM

Both centralized and decentralized stablecoins face challenges

- Centralized (USDC and USDT) are at risk due to reliance on traditional financial systems (read censorship)

- Decentralized grapple with scalability and design challenges

(DAI is capital inefficient due to over-collateralization)

Remember TERRA!

3/

Ethena's Solution

USDe ≠ Stablecoin

- Crypto-native synthetic dollar

- Scalable & capital-efficient

- Addresses the scalability challenges faced by decentralized stablecoins and the custodial risks of centralized ones (by moving collateral out of traditional banks)

4/

Ironically, USDe isn't the first delta-neutral synthetic dollar

Previous iterations (like UXD) relied on decentralized venues that lacked liquidity, weren't scalable & vulnerable to smart contract exploits

Open interest in CEXs is over 20x larger than in DEXs, highlighting the critical need to leverage CEX liquidity

5/

How is USDe different?

- Scalable and Stable

Through the use of derivatives, allowing USDe to scale efficiently with only 1:1 collateralization, as backing assets are perfectly hedged upon issuance with equivalent short positions ensuring the synthetic USD value remains secure

- Censorship Resistant

By keeping backing assets outside the banking system, stored onchain in transparent, auditable custody accounts

6/

In short,

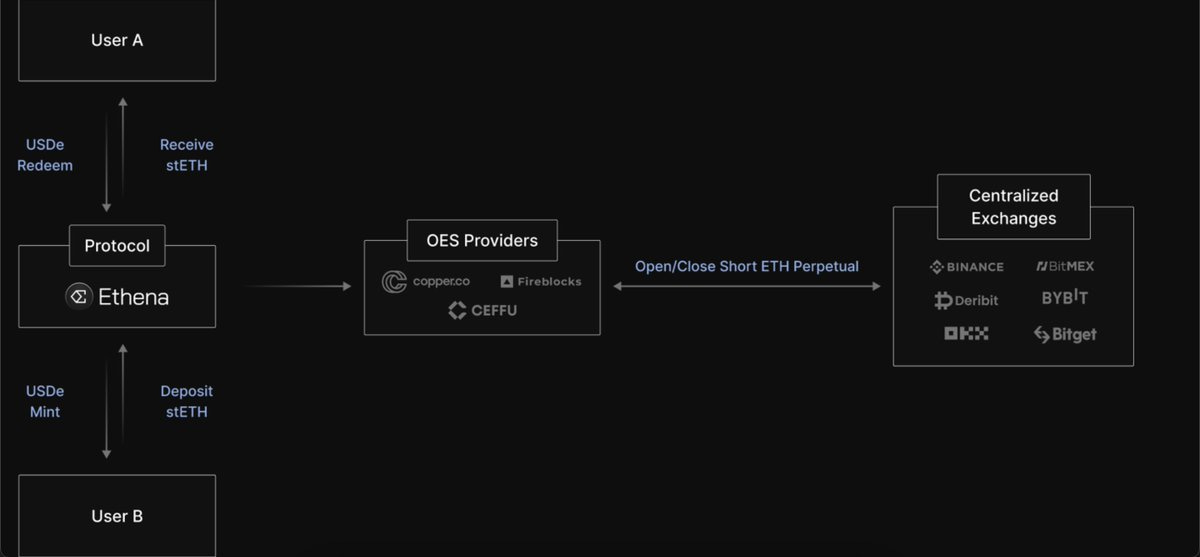

Ethena operates entirely within the crypto ecosystem by opening a short position of the collateral asset

The system uses crypto collateral, crypto exchanges, and other crypto-based platforms, completely bypassing traditional banks

Ethena executes a delta-neutral trade using perpetual exchanges and captures yield on both sides

- Yield from staked ETH (collateral) on one side

- Yield from funding rates by shorting ETH on the other side

7/

Why should you look at USDe?

Provides a stable, onchain savings option

How?

Staking USDe automatically earns rewards

- Collateral includes staked Ethereum (ETH staking returns)

- Income from futures trading, like funding fees and basis spreads, is distributed to USDe stakeholders

8/

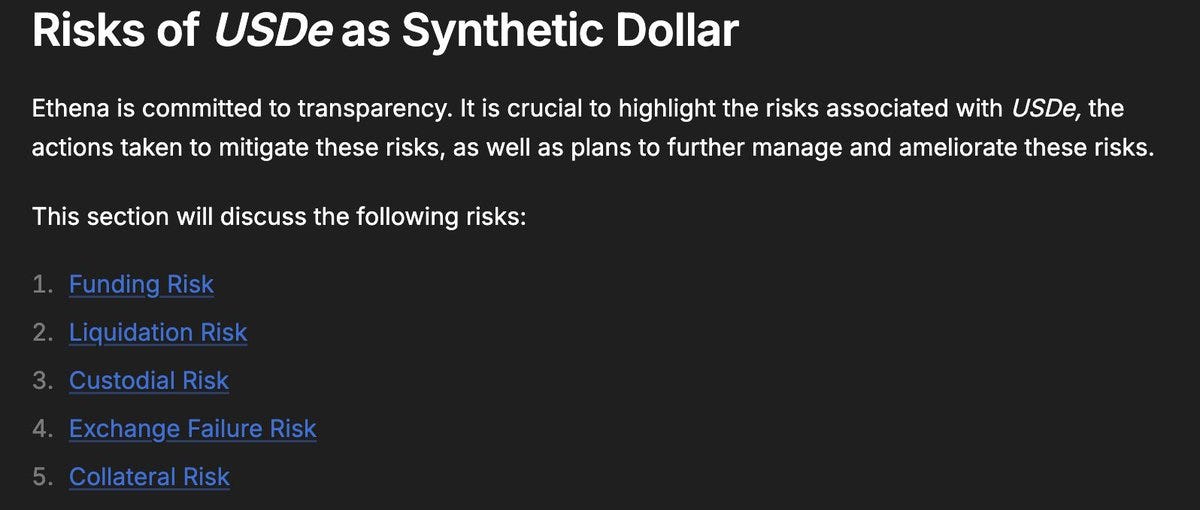

While USDe offers many benefits, it's not without risks

*Ethena uses Off-Exchange Settlement providers to hold backing assets, allowing it to delegate & undelegate collateral to CEXs without being exposed to exchange-specific risks

If you find this helpful, please support us by subscribing and following.

Everythingblockchain — Freethinkers, Writers ✍, Blockchain explorers 🔭

In pursuit of simplifying the different blocks of the chain metaverse

Socials

Twitter, Medium, Youtube, Reddit, Substack

The information provided through this work is intended solely for educational purposes and must not be treated as investment advice. Any lapses in presenting any of the information correctly are ours alone. We disclaim any liability associated with the use of this content.