HAI - A decentralized and overcollateralized stablecoin

Ever heard the saying “Don’t get high on your own supply”?

Well, HAI flips that on its head

Use LSTs & OP native assets as collateral to get HAI — a decentralized and overcollateralized stablecoin

Ready to get HAI? Let’s dive in

1/ Introduction to @letsgethai

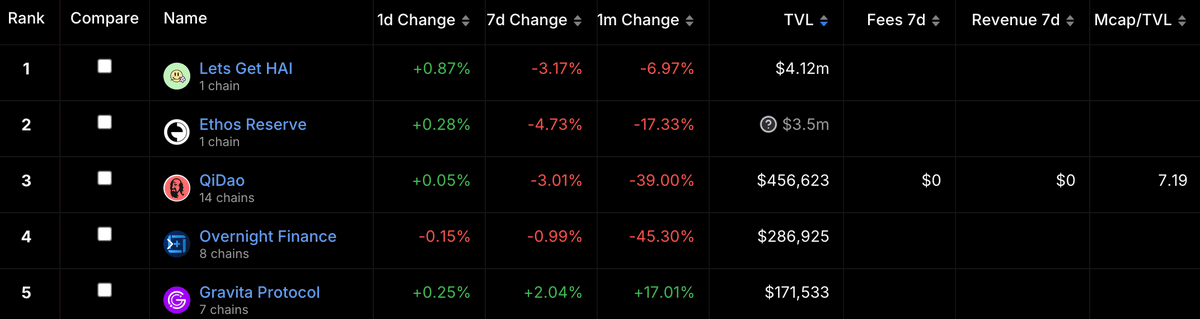

Largest CDP protocol on #Optimism

Where you can deposit collateral like WETH, wstETH, rETH, OP, etc., and take a loan in HAI

Over 45% of TVL across all CDPs on OP is in HAI Vaults

2/ HAI An over-collateralized CDP-minted stablecoin

Has a diverse collateral base including LSDs & other tokens

Uses a floating peg, unlike USDC/USDT, which are hard pegged to the $

The peg is set by a Proportional-Integral-Derivative (PID) controller to induce stability

3/ HAI has two important prices

• Market Price (MP): What people are paying for HAI in the market

Redemption Price (RP): What the HAI system believes HAI should be worth, initially $1

4/ HAI mechanics

The system uses a smart PI controller to adjust HAI’s value

If MP > RP

The system sets a negative interest rate, making it cheaper to owe HAI over time

This encourages selling HAI to stabilize the price

5/

If MP < RP

The system sets a positive interest rate, making it more expensive to owe HAI over time

This prompts buying HAI to pay off debts, pushing the price up

6/

These adjustments help keep HAI’s value close to $1, balancing supply and demand

Basically, HAI’s smart controller tweaks interest rates based on market conditions to keep its value stable

HAI is a multi-collateral fork of RAI @reflexerfinance with the same basic mechanics

7/ Simplified

The market price of HAI can’t deviate from the RP for too long due to smart incentives

If the price is too high, people borrow and sell HAI

If the price is too low, borrowers buy back HAI

This helps keep HAI’s value stable and in line with its target RP

8/

Ensuring that it remains a reliable and predictable stablecoin

Users must carefully manage HAI minting

If collateral value drops too much, it can be seized and sold in a collateral auction to protect HAI’s value and ensure confidence in the protocol

9/ KITE

Governance token for ensuring a decentralized and community-driven approach

KITE holders can vote on system changes and the protocol’s development, like adding/removing collateral types

10/ Plus, HAI boasts the best dapp design in the game

It’s user-friendly and efficient

Easy to deposit collateral and take out loans

Check it out for yourself and get HAI on your own supply

11/ Official Links

Discord

https://discord.com/invite/pX8m6zXNKu…

Telegram

https://t.me/+0iIhX0f9DDAxODE5…

Website

https://www.letsgethai.com/