The Deflationary Dynamics of $RWA: Revenue Sharing and Beyond

Crypto Twitter conversations often highlight the demand for real use cases over the next L1/L2 solution promising faster speeds or lower costs. While these improvements are beneficial, the space remains fragmented and lacks real composability.

Real composability, huh? This is where re.al comes in, a project developed with a clear use. For a quick introduction, do check out my thread https://x.com/EverythingB0x/status/1809524898605461717

Today, however, we will dive into the intricate tokenomics of the protocol’s $RWA token.

Collective Ownership and Governance: $RWA Vision

$RWA represents a bold vision for the future of collective ownership and L2 governance, combining value accrual and governance rights into one deflationary token.

RWA is a migrated version of the TNGBL (governance token of TangibleDAO)

Inheriting several features from it but introduces updated vote escrow contract tokenomics and a taxing system on buys/sells

Key Features of $RWA Tokenomics

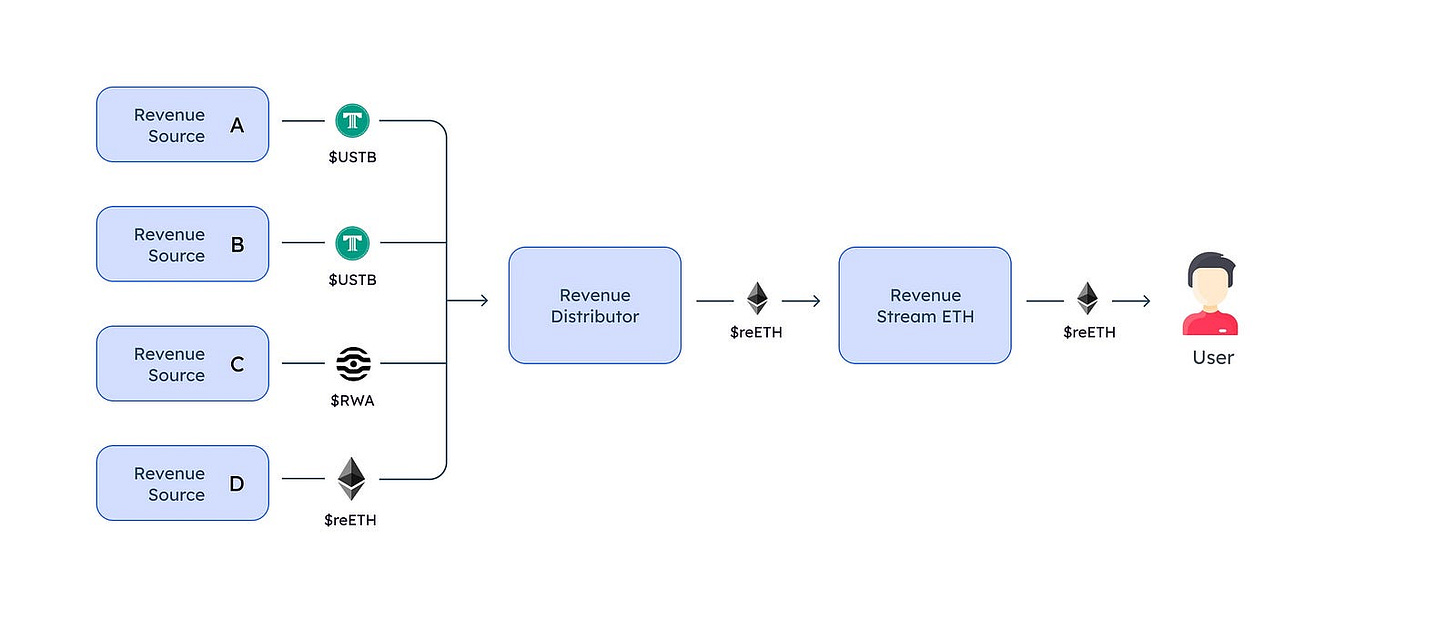

Revenue Sharing: Locking $RWA into veRWA grants users a proportional share of all chain revenue, including 100% of transaction fees and revenues from various products and protocols on re.al. This mechanism supports the protocol’s growth and discourages premature token sales with hefty penalties for breaking the lock (more below).

Lock Duration and Voting Power: The core of $RWA tokenomics lies in the relationship between lock duration, voting power, and burn mechanics. Longer lock durations increase voting power and revenue share allocated to veRWA positions. This lock-up buys time to grow the protocol, adoption, and revenue.

Burn Mechanics: Users can either vest their veRWA for the full lock duration, receiving no rewards until the end, or unlock early and burn a percentage of the locked tokens as a penalty. Additionally, a 2% transaction tax on all $RWA buys and sells creates deflationary pressure, making $RWA scarcer over time and rewarding long-term holders with a larger share of future revenue.

Demand-Driven Value

The true value of $RWA lies in its demand within the protocol. Increasing token demand exponentially enhances its value, integrating the token with the protocol’s functions and ensuring significant value capture.

Utility and Integration: $RWA is essential for governance and revenue sharing within the re.al protocol, ensuring it remains a critical component rather than a speculative asset.

Yield Generation: Locking $RWA into veRWA provides yields from ecosystem activities. As the ecosystem grows, more yield flows back to veRWA holders. Unlike many tokens, $RWA is never minted as yield, but new protocols might airdrop tokens to veRWA holders in the future.

reETH: veRWA yield is distributed in reETH, a value-accruing LST, and the native gas token on the chain. reETH is value-accruing, meaning it goes up in value vs ETH thus, reETH creates an optimal environment for yield seekers.

Win-Win Ecosystem

re.al returns all chain revenues to veRWA holders and encourages protocols to share their revenue with token holders. This strategy supports the growth of the ecosystem by redistributing earnings. Additionally, using off-chain yields for liquidity incentives, re.al creates a system where everyone benefits. This approach will keep the ecosystem thriving and ensure veRWA holders receive all the benefits.

Fair Play

No Minting: No new RWA tokens can be minted

Circulating Supply: The entire supply (100%) of RWA, either locked or unlocked, is in circulation with no future team or VC unlocks.

Creating a token is easy, but sustainability requires robust economics that support growth and deliver value to users. In Web3 we call this — Sustainable Tokenomics.

The entire $RWA supply is already in circulation, eliminating risks such as VCs dumping their tokens. This is crucial in a market where most coins have low float and high FDV, with frequent VC unlocks that disadvantage retail investors.

The re.al team’s efforts are aimed at building an ecosystem that rewards long-term participation and sticky liquidity, offering consistent incentives and profit-sharing. RWA is not just another valueless governance token.

What did they do differently?

Ensured the token is trading and fully circulating

Enabled $RWA to be locked for earning real revenue, not just for governance

94.26% of the total tokens in circulation are locked

Conclusion

re.al and its $RWA token set a new standard for L2 tokens by emphasizing long-term sustainability and benefits. With deep integration, robust value capture, and a focus on demand, re.al paves the way for a more interconnected and efficient blockchain ecosystem, highlighting the importance of practical use cases.

If you find this helpful, please support us by subscribing and following.

Everythingblockchain — Freethinkers, Writers ✍, Blockchain explorers 🔭

In pursuit of simplifying the different blocks of the chain metaverse

Socials

Twitter, Medium, Youtube, Reddit, Substack

The information provided through this work is intended solely for educational purposes and must not be treated as investment advice. Any lapses in presenting any of the information correctly are ours alone. We disclaim any liability associated with the use of this content.